florida estate tax exemption 2021

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. November 28 2021 alison brie dave franco.

![]()

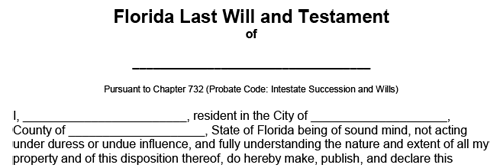

Florida Inheritance Tax Beginner S Guide Alper Law

Extending the expiration date of the sales tax exemption for data center property.

. In 2021 the annual gift tax exemption is 15000 meaning a person can give up 15000 to as. Florida estate tax exemption 2021. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all.

Also the phaseout threshold increases to 523600 1047200 for married filing jointly. If your estate is worth less than this youll need to pay the federal income tax as well as any possible federal income taxes. 813 245-1157 Real estate agents affiliated with Coldwell Banker are independent contractor sales associates and are not employees of the company.

Application by March 1 of the tax year shall constitute a waiver of the exemption privilege for that year. The exemption increases with inflation. Assessed Value 85000 The first 25000 of value is exempt from all property tax the next 25000 of value is taxable the third.

A person is considered to reach age 65 on the day before his or her 65th birthday. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. Starting in 2022 the exclusion amount will increase annually based on. Property in the State of Florida and who resides thereon.

2022 Annual Gift Tax Exclusion - increased to 16000 from 15000. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Income over 445850501600 married.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. This means that the estate tax liability will no longer impact just the rich.

Married Filing Separate - 12550. Ncome up to 40400 single80800 married. Income over 40400 single80800 married.

Citizen the Florida estate tax exemption amount is still 114 million. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. But once you begin providing gifts worth more than the applicable annual limit to any individual in a.

Individuals and families must pay the following capital gains taxes. However if the current federal tax laws remain in place the exemption amount will be decreased by 50 in 2026. Still individuals living in Florida are subject to the Federal gift tax rules.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. Bob Hodge Realtor 500 N Westshore Blvd Ste 850 Tampa FL 33609 Office Phone.

Estate Tax Exemption for 2021 The estate tax exemption in 2021 is 11700000. While the reduction will not impact many people it will impact enough. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public service workers including teachers law enforcement officers emergency medical personnel active duty members of the military and Florida National Guard and child welfare service employees.

Tax Year 2021 Standard Deduction and Exemptions filed in 2022 Single - 12550. Except as otherwise expressly provided in this act this act shall take effect July 1 2021 Last Action. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

This is approximately a 70 reduction in the current estate tax exemption. As of 2021 the income limitation is 3110000 meaning you cannot qualify for this additional homestead exemption for seniors if your adjusted gross income exceeds this amount. 25000 of value is exempt from non-school taxes.

Even if youre a US. 813 286-6563 Cell Phone. Alternative Minimum Tax AMT In 2021 AMT exemption amounts increase to 73600 for individuals up from 72900 in 2020 and 114600 for married couples filing jointly up from 113400 in 2020.

Every person who has legal or equitable title to real. What is the Senior Citizen Income Limitation for this Additional Homestead Exemption. 3 Oversee property tax.

Federal Estate Tax. Qualifying Widower - 25100. Married Filing Joint - 25100.

5242021 - Chapter No. This means that when someone dies and. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. The first 25000 of value is exempt from all property tax thenext 25000 of value is taxable and 15000 of value is exempt from non-school taxes. The current rate is an estate tax exemption of 11700000 per person 2340000 per married couple.

Thursday November 18 2021 Increases in Estate and Gift Tax Exemption Amounts Announced by IRS We have gone from scrambling to deal with a decrease in the unified credit under proposed legislation to now enjoying the 2022 inflation adjustments. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Head of Household - 18800.

If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes.

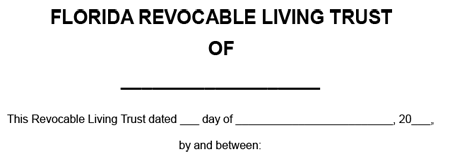

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Estate Planning Guide Everything You Need To Know

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Estate Planning Guide Everything You Need To Know

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

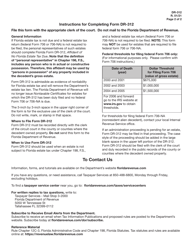

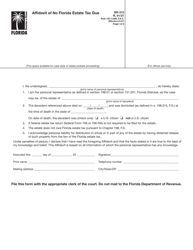

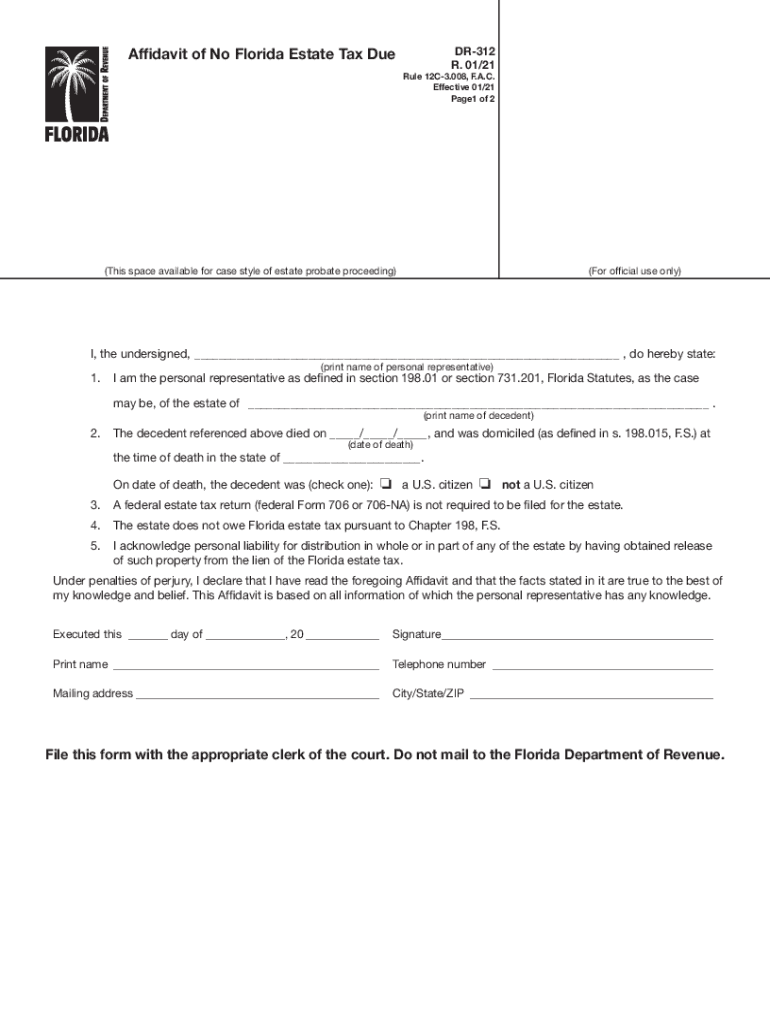

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Estate Tax Landscape For 2021 And Beyond

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Generate Leads Lead Generation Generation Entertaining

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Get Fl Dor Dr 312 2021 2022 Us Legal Forms

Docreviewers Earn More Money Estate Planning How To Plan

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Property Tax H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die